Rural Business and Community Enterprise Fund

3. Eligibility

Any organisation with legal status can apply for funding. Given the aim of this Fund, this may be private sector companies or voluntary organisations, registered charities or local authorities.

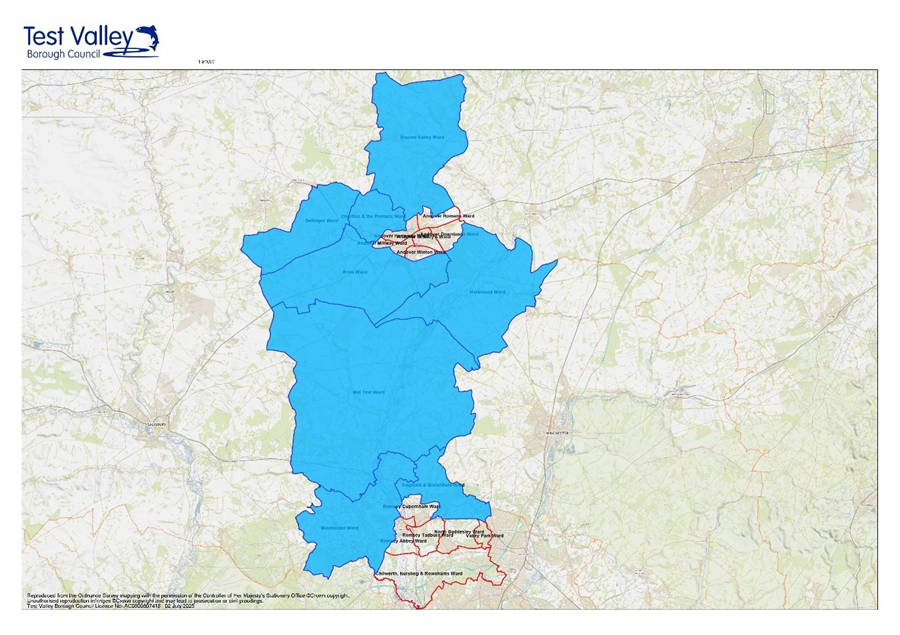

Projects must be in a rural area. For the purposes of these grants, rural areas are as defined by the Test Valley Corporate Plan and can be seen in the supporting map:

To apply, you must:

- be constituted or trading at the time of application;

- have any trading licences in place that are relevant to your enterprise. For example, hospitality businesses should be registered as a food business with Test Valley Borough Council;

- have a UK bank account for your business or organisation;

- have relevant and valid insurances in place such as public, employer and product liability insurance.

We cannot fund the following:

- applicants who are in arrears for business rates with Test Valley Borough Council;

- applicants who are subject to any enforcement order for a breach of planning regulations;

- domestic property improvements.

- the purchase of private vehicles.

- enterprises located outside the eligible Test Valley rural area

- projects for which capital assets would be on land or property not owned or leased by you.

- projects for which the necessary planning consent has not been secured at the time the work is done.

- projects or costs where there is a statutory duty to provide them.

- projects that could be fully funded using private finance.

- organisations in serious financial difficulty or that have ceased trading.

- businesses for whom receipt of the requested grant from the Council will exceed the Minimum Financial Assistance (MFA) threshold for the business as specified in section 36(1) of the Subsidy Control Act (2022). The total amount of 'Minimum Financial Assistance' (MFA) received over a rolling period of three fiscal years should not exceed £315,000 per business including the total amount of MFA received over the relevant period of three fiscal years across all businesses at company group level (including the grant you are applying for);

- Projects which may be construed as radicalising or encouraging people into terrorism, to ensure compliance with the Counter-Terrorism and Security Act 2015[1].

- Churches (for community spaces only and not spaces used exclusively as places of worship)

Please note that the grants are discretionary. Being an eligible enterprise does not give you any automatic entitlement to a grant.

[1] Any activity which may be construed as radicalising or encouraging people into terrorism must be reported. Should any allegation be received, or if the Council has reason to suspect noncompliance, the Council will investigate and may decide to cancel, modify or withdraw any offer or grant made to ensure compliance with the Counter-Terrorism and Security Act 2015.